Imagine this: You’re standing on the cusp of a thrilling adventure, poised to acquire a new business or a rich portfolio of assets. But before you step into this uncharted territory, there is one companion you need by your side – Form 8594. This isn’t just a mere document; it’s the compass guiding your journey through the complex asset allocation landscape.

As if straight out of a suspense novel, Form 8594 acts as the secret code to unravel the intricate puzzle of purchase price distribution across various asset categories. It’s the hidden agreement shared in hushed whispers between buyer and seller, ensuring everyone is on the same page about the value of each deal component.

So come, join us in this engaging exploration of Form 8594, where numbers morph into narratives and fiscal obligations become thrilling quests. The world of asset acquisition is a lot more intriguing than you may have thought. Buckle up and prepare for an exhilarating journey!

Key Takeaways

- If you’re acquiring a group of assets that constitute a trade or business, both the buyer and seller must file Form 8594 and attach it to their tax returns for that year.

- Form 8594 should also be used to report the sale if goodwill or going concern value is attached to the assets or could potentially attach.

What is Form 8594 – Asset Acquisition Statement?

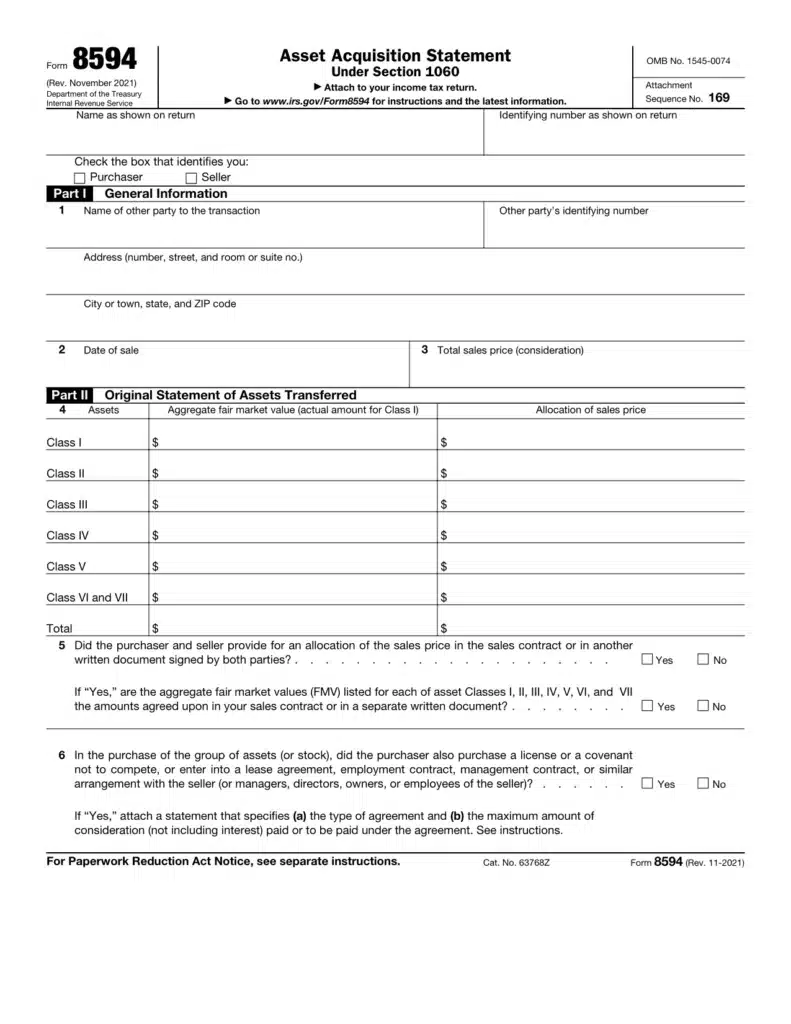

Form 8594 is a document that must be filed by both the seller and buyer of a group of assets that constitute a trade or business.

It is required when the buyer’s basis in such assets is determined solely by the total selling price. The form allocates the purchase price among the seven asset categories outlined by the IRS.

Unless the IRS determines it is inappropriate, this allocation is binding on both parties. To appropriately fill out Form 8594, the buyer and seller must enter a written agreement on how the sales price will be allocated among the asset categories.

The residual method must be used to allocate the purchase price, meaning each asset category is allocated in a specific order until the full purchase price is accounted for.

Related Post: 1099 Form: What You Need to Know as a Recipient

Understanding Fair Market Value

Fair market value is vital when filling out Form 8594 for asset acquisition.

It refers to the price an asset would sell for on the open market when both the buyer and seller are knowledgeable about the purchase and are under no pressure to sell or buy.

When completing Form 8594, this value determines the gross fair market value of assets transferred. This value is then reduced by any mortgages, liens, pledges, or other liabilities associated with the assets.

The fair market value is at least as much as any non-recourse debt that the property has. Any liabilities incurred due to the acquisition should also be considered.

Additionally, any liability that comes with the acquisition of property is only disregarded if it was not previously considered when determining the basis of the property.

Residual Method: Allocating Price to Group of Assets

The residual method allocates the purchase price among the seven asset categories on Form 8594. The method allocates the sales price to each asset category in a specific order until the total purchase price is accounted for.

The asset categories are divided into seven classes, each with a different priority in the allocation order.

Class I assets, which include cash and general deposit accounts, have the highest priority, followed by Class II assets, which include actively traded personal property such as stocks and bonds.

Class III assets include accounts receivable, while Class IV assets include property that would properly be included in the taxpayer’s inventory.

Class V assets are all assets that don’t fall into any of the other categories – Class I, II, III, IV, VI, or VII. On the other hand, Class VI assets refer to all section 197 intangible assets, except for goodwill and going concern value, which is classified as Class VII assets.

Do You Need to File Form 8594?

If you’re acquiring a group of assets that constitute a trade or business, you must file Form 8594.

This applies whether the company’s assets are a trade or business in the hands of both the seller and buyer. The buyer and seller must file Form 8594 and attach it to their income tax returns.

You should file individual income tax returns (Forms 1040, 1041), partnership returns (Form 1065), corporation returns (Forms 1120, the 1120S), and other applicable tax forms.

In most cases, you should file form 8594 with the income tax return for the year the sale took place. If goodwill or going concern value is attached to the assets or could potentially attach, Form 8594 should be used to report the sale.

Form 8594 Instructions: Asset Classes Explanation

To properly allocate the purchase price among the asset categories on Form 8594, it’s essential to understand the seven asset classes.

Class I assets

Class I assets include cash and general deposit accounts, such as savings and checking accounts, and savings and loan associations, held in banks and other depository institutions.

Class II assets

Class II assets include actively traded personal property, such as stocks and bonds, U.S. government securities, and certificates of deposit and foreign currency.

However, Class II assets do not have stock of the seller’s affiliates, whether or not it is actively traded.

Class III assets

Class III assets (Debt Instruments) include accounts receivable, while Class IV assets include property that would properly be included in the taxpayer’s inventory at the end of the tax year.

Class V assets

Class V assets include all that do not fall under Class I, II, III, IV, VI, or VII. This category comprises many items, such as buildings, furniture and fixtures, vehicles, and equipment – all or part of a trade or business.

Class VI assets

Class VI assets include all section 197 intangibles, except for goodwill and going concern value. Section 197 intangibles include workforce, business records, operating systems, databases, methods, designs, patterns, know-how, formulas, and similar items reliant on consumers or suppliers or issued by a government unit.

Class VII assets

Class VII assets represent the excess of the purchase price over the fair market value of other assets acquired and classify goodwill and going concern value.

Goodwill is an intangible value associated with a company’s reputation, branding, customer perception, and overall standing in the business community. It represents the extra value paid for an asset or business over its net asset value (or book value)

In Conclusion

IRS Form 8594 is essential for adequately allocating the purchase price among the different asset categories in an acquisition.

Remember that both seller and buyer must file Form 8594 when transferring a group of assets constituting a trade or business and attach it to their income tax returns.

Fair market value is crucial to properly allocate the purchase price among the different asset categories on Form 8594, and you should any non-recourse debt and liabilities incurred due to the acquisition.

Completing Form 8594 is essential for a successful acquisition and can help simplify the process for buyers and sellers.

By following the guidelines and understanding the asset categories and allocation methods, you can ensure compliance with tax laws and regulations and avoid potential issues with the IRS.

Need Help with Tax Form 8594?

Do you need help with filing Tax Form 8594 for your business acquisition? Don’t worry; we’ve got you covered!

Our expert team can guide you through the process and ensure you comply with tax laws and regulations.

Filing Form 8594 can be confusing and time-consuming; failure to do so correctly can result in penalties and legal issues. However, by working with us, you can simplify the process and avoid these problems.

Our experienced team can help you properly allocate the purchase price among the different asset categories and ensure your tax return is accurate and complete.

Don’t let the complexities of Form 8594 hold you back from a successful acquisition. Contact us today and let us help you navigate the process and enjoy the benefits of a successful business transaction.

>>You may find interesting: What Happens If You Get Audited And Don’t Have Receipts?

anywhere

anywhere  anytime

anytime