Filing your taxes can be a complicated and intimidating process, especially regarding Schedule 2 Form 1040. Confronting this task without the necessary knowledge or understanding of current tax laws can lead to significant problems – resulting in errors, omissions, penalties, and fines.

This article will help you navigate the form correctly to determine the amount of taxes due.

Key Takeaways

- On Form 1040 Schedule 2, you can report any extra taxes that must be paid, including investment income, self-employment taxes, and Alternative Minimum Tax.

- Remember to report your adjusted gross income from Schedule 1 to Schedule 2; this will help the IRS accurately determine any additional taxes you may owe.

What is Schedule 2 on the Form 1040?

The IRS created Form 1040 and other schedules for 2019 and future tax years to simplify filing taxes. To submit a precise and comprehensive form, you must remember what additional taxes you should note on your Schedule 2.

In Form 1040 Schedule 2, you can report additional taxes you may owe, such as investment income, self-employment taxes, or alternative minimum tax (AMT). You must complete and submit it along with form 1040.

Who needs to use Schedule 2?

Anyone who owes additional taxes beyond what was already withheld or reported on their 1040 form must complete this schedule. This includes:

- Individuals paying self-employment tax

- Household employee tax

- Certain types of deposit interest

- Recapture taxes for qualified education expenses

- The renewable energy production credit

- Alternative minimum tax (AMT)

Those with unpaid estimated taxes for the current year should also report them on Form 1040 Schedule 2.

How to Fill out Schedule 2: The Comprehensive Guide

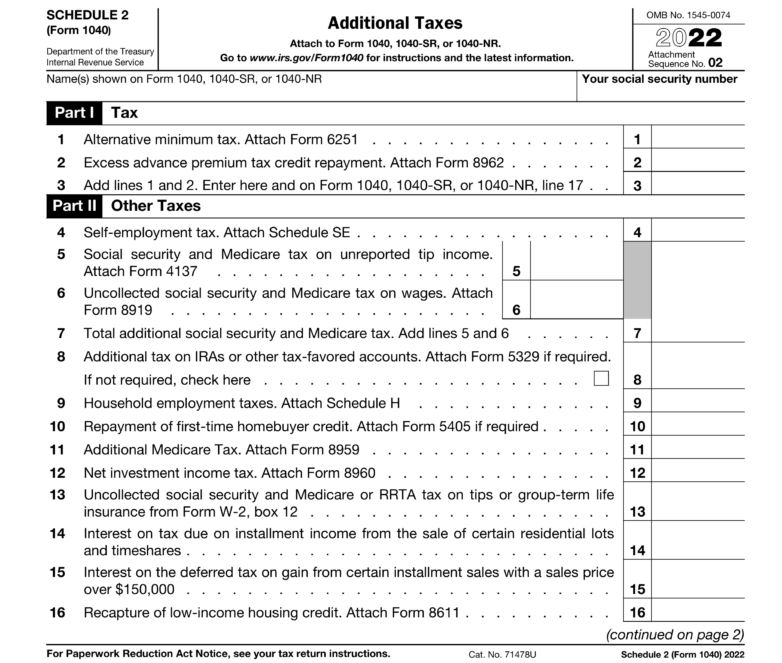

Schedule 2 Form 1040 consists of Taxes and Other Taxes. It is essential to carefully and accurately complete these sections to ensure a complete income return.

Part I – Taxes

The Taxes portion helps you add all the additional taxes you owe and enter them into this section. This include:

Alternative Minimum Tax (Attach Form 6251)

- Line 1: Enter the amount from Form 6251. Remember to attach Form 6251.

Excess Advance Premium Tax Credit Repayment (Attach Form 8962)

- Line 2: If you received this credit before, you need to note any excess advance premium tax credit repayment. You should enter the amount and attach form 8962 when submitting.

- Line 3: You enter the total of lines 1 and 2 on this line and enter on these tax forms: line 17 of form 1040, form 1040-SR, and form 1040-NR.

Part II – Other Taxes

This portion relates to taxes not outlined in Part I. This part has seven lines:

Self-employment tax – Line 4

You’ll need to enter the amount you owe in self-employment tax if you’re self-employed. Remember to attach Schedule SE.

Unreported Social Security (Attach Form 4137) and Medicare Tax (Attach Form 8919) – Lines 5 and 6

To correctly calculate the due social security and Medicare taxes, you must enter the amounts from form 4137 and form 8919.

Note: Use Form 8919 to determine the unreported tax from an employer who didn’t withhold social security and Medicare tax.

Additional tax on IRAs or other tax-favored accounts, etc. (Attach Form 5329 if required) – Line 8

In form 5329, you’ll find out the amount you owe and attach this form when submitting.

- You received an early distribution from an IRA, annuity, or modified endowment contract after June 20, 1988, without rolling over the total amount.

- Excess contributions were made to your IRA, Coverdell ESA, Archer MSA, HSA, or ABLE account.

- You received a taxable distribution from a Coverdell ESA, qualified tuition program, or ABLE account.

- You should have taken the required minimum distributions from your IRA or another qualified retirement plan by April 1, following the year you reached age 72.

Household employment taxes (Attach Schedule H) – Line 9

Enter the amount from form Schedule H (line 8d or 27) if you have any household employees.

Repayment of first-time homebuyer credit (Attach Form 5405 if required) – Line 10

If you purchased a home in 2008 and used it as your primary residence throughout 2022, you can enter your repayment amount for 2022 on this line without attaching Form 5405.

Additional Medicare Tax (Attach Form 8959) – Line 11

Individuals with income over certain thresholds are subject to the Additional Medicare Tax, implemented as part of the Affordable Care Act in 2013. The prescribed point incurs a 0.9% tax rate on any amount that exceeds it.

If your wages or self-employment income for 2022 exceeds certain levels, you may owe Additional Medicare Tax:

- $125,000 if married, filing separately;

- $250,000 if married, filing jointly; or

- $200,000 if single, head of household, or qualifying surviving spouse.

Additionally, check Form 8959 if you have railroad retirement (RRTA) compensation greater than these amounts. Your employer might have withheld this tax even if you’re not liable; in such cases, you may be eligible to receive a refund on said withholding.

Net Investment Income Tax (Attach Form 8960) – Line 12

For individuals, estates, and trusts with net investment income that surpasses a certain threshold, the 3.8% Net Investment Income Tax (NIIT) is an additional imposition.

If modified adjusted gross income on Form 1040, 1040-SR, or 1040-NR, line 11 is higher than:

- $125,000 if married, filing separately

- $250,000 if married, filing jointly, or qualifying surviving spouse

- $200,000 if single or head of household.

Then you may be subject to the NIIT.

Line 13 – Uncollected social security and Medicare or RRTA tax on tips or group life insurance from W-2

Employees and employers may need to include this amount when filing, as it comprises both tax portions.

The IRS requires employers to withhold these taxes and then remit them directly to the government, so employees need to note any amounts reported on Line 13 of Form W-2

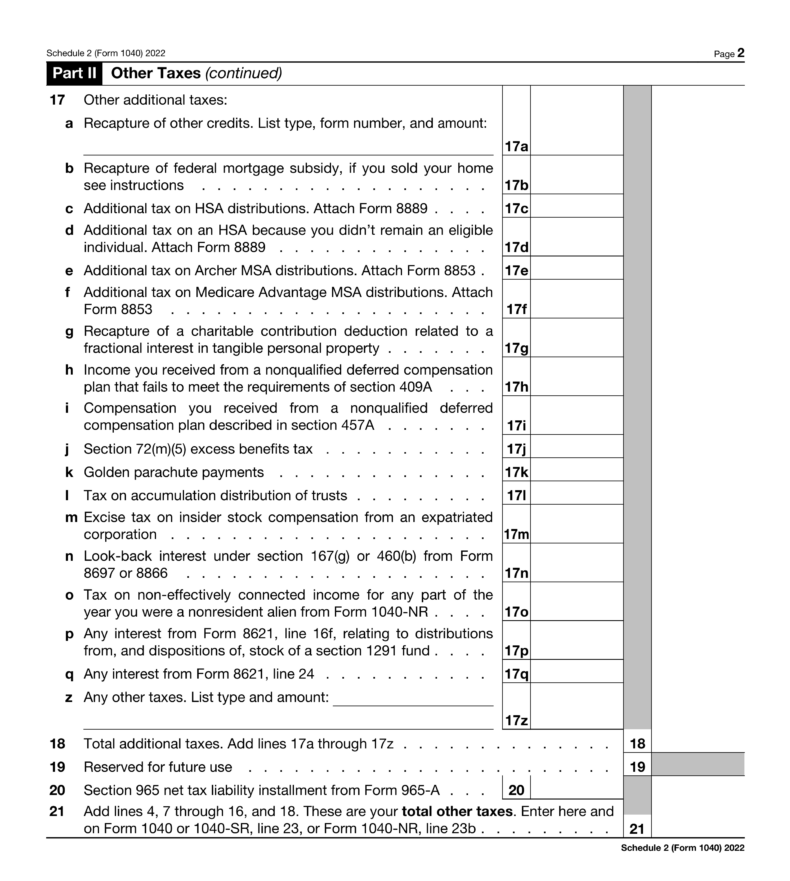

Other Additional Taxes – From Line 14 – 17

To calculate any additional taxes due, follow the IRS instructions. You start by adding 17a to 17z and entering the sum into line 18. After that, add all other applicable taxes to line 21. Finally, add the amount of line 21 to line 23 in Form 1040 and attach Form 1040, 1040-SR and 1040-SR to your filing.

For example, if your taxable income is $80,000 and you are subject to a 10% tax rate, Line 18 would be: [80, 000 * 10 % = 8,000].

Line 21 of Schedule 2 and Line 23 in Form 1040 would be the total amount due for that filing period ($8,000 + any other applicable taxes).

In Conclusion

Completing form 1040 Schedule 2 can seem daunting, but as long as you understand your liabilities and obligations, the form is relatively straightforward. Tax law varies depending on your situation, so consult a local tax professional if you have any questions or concerns about form 1040 schedule 2.

Additionally, double-check that you fill out all forms and schedules accurately to avoid any penalties from the IRS. For more helpful information, subscribe to our blog to stay up-to-date on form 1040 schedule 2 and other important tax topics.

anywhere

anywhere  anytime

anytime