Get your

Payroll

Book

Tax

Payroll

Book

Tax

Payroll

Book

Tax

DONE RIGHT

Maximize deductions and ensure compliance

with our expert tax solutions. Focus on growth.

we handle the tax details.

Certified Experts With Powerful Bookkeeping System

How Can We Help You #Thrive

Expertise in Accounting, Bookkeeping, Payroll, and Business Formation tailored

to empower your business journey.

Tax Preparation

Get your tax done right to stay on top of your finance and run your business smoothly

Bookkeeping

XOA TAX knows your anguish and aims to deliver up to date, accurate records every month.

Payroll

User-friendly monthly, quarterly, annual payroll tax reports with us. Easy and clear.

Business Formation

Launch your business in the U.S. today with our team of CPAs and attorneys.

Expert

Tax Attorneys

CPAs

Tax Attorneys

CPAs

Tax Attorneys

CPAs

Tax Attorneys

CPAs

Tax Attorneys

CPAs

Tax Attorneys

CPAs

Tax Attorneys

CPAs

are available 24/7.

Our team of dedicated experts and attorneys have years of experience solving the most challenging problems for our clients. We're well-equipped and prepared to meet all your needs.

Explore real-life case studies, showcasing personal and business successes

that inspire and inform

# Tax #Accounting

E-commerce

Startup

The Situation

In 2019, Mr. Jackson, an experienced businessman who owns a range of various companies, started an exciting new online store. Even though he had a lot of experience, he depended on a personal accountant to help him with the complicated finances of his new business.

Even though the accountant was skilled, they didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

In 2019, Mr. Jackson, an experienced businessman who owns a range of various companies, started an exciting new online store. Even though he had a lot of experience, he depended on a personal accountant to help him with the complicated finances of his new business.

Even though the accountant was skilled, they didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

The solution

To deal with these issues, Mr. Jackson reached out to our professional services. We decided to gather all the necessary documents and paperwork ever since to correct the tax records and assessments. This effort was essential to avoid potential pitfalls associated with incorrect tax filings.

The result

“He was able to avoid being audited, and

make his first online store thrive!”

If we hadn't fixed these tax problems, the business would have run into some serious trouble down the road. Making mistakes in tax filings could have triggered an audit in the future, leading to substantial financial burdens and the risk of harming the company's good name.

By dealing with these financial issues, we essentially removed a major obstacle, enabling the business to keep growing without worrying about audits and financial penalties on the horizon.

E-commerce Startup

In 2019, Mr. Jackson, an experienced businessman who owns a range of various companies, started an exciting new online store. He didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

# Tax #Accounting

Stuck In A

Special Situation

The Situation

Dustin and Rosie, a middle-aged couple, chose to do something brave. They sold their family home and all their assets to invest in the stock market. As their gamble paid off, they made a substantial profit. However, with great profits came a significant tax liability. Unprepared for this, they were faced with a tax bill of over 2 million USD.

Dustin and Rosie, a middle-aged couple, chose to do something brave. They sold their family home and all their assets to invest in the stock market. As their gamble paid off, they made a substantial profit. However, with great profits came a significant tax liability. Unprepared for this, they were faced with a tax bill of over 2 million USD.

The solution

Recognizing the seriousness of their situation, Dustin and Rosie sought our assistance. We connected them with a board-certified tax attorney who had a wealth of experience in handling tax-related challenges.

The tax attorney prepared and sent a detailed report to the IRS, explaining the couple's financial difficulties. The argument made was that, despite their profit, they couldn't reasonably afford such a high tax bill because they had already invested all their life savings and assets in the stock market.

The result

“He was able to avoid being audited, and

make his first online store thrive!”

After a thorough review, the IRS understood their situation and decided to reduce their tax bill by more than half. This substantial reduction saved Dustin and Rosie over $1 million USD. With this financial relief, they could eventually handle their life without the overwhelming burden of excessive debt.Even though the accountant was skilled, they didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

The solution

To deal with these issues, Mr. Jackson reached out to our professional services. We decided to gather all the necessary documents and paperwork ever since to correct the tax records and assessments. This effort was essential to avoid potential pitfalls associated with incorrect tax filings.

The result

“He was able to avoid being audited, and

make his first online store thrive!”

If we hadn't fixed these tax problems, the business would have run into some serious trouble down the road. Making mistakes in tax filings could have triggered an audit in the future, leading to substantial financial burdens and the risk of harming the company's good name.

By dealing with these financial issues, we essentially removed a major obstacle, enabling the business to keep growing without worrying about audits and financial penalties on the horizon.

Stuck in a special situation

Dustin and Rosie were faced with a tax bill of over 2 million USD when they invested in the stock market. Knowing the gravity of their situation, they reached out to us for help. With years of experience in solving tax issues, our tax attorney sent the

#Business Formation

Plan to Success

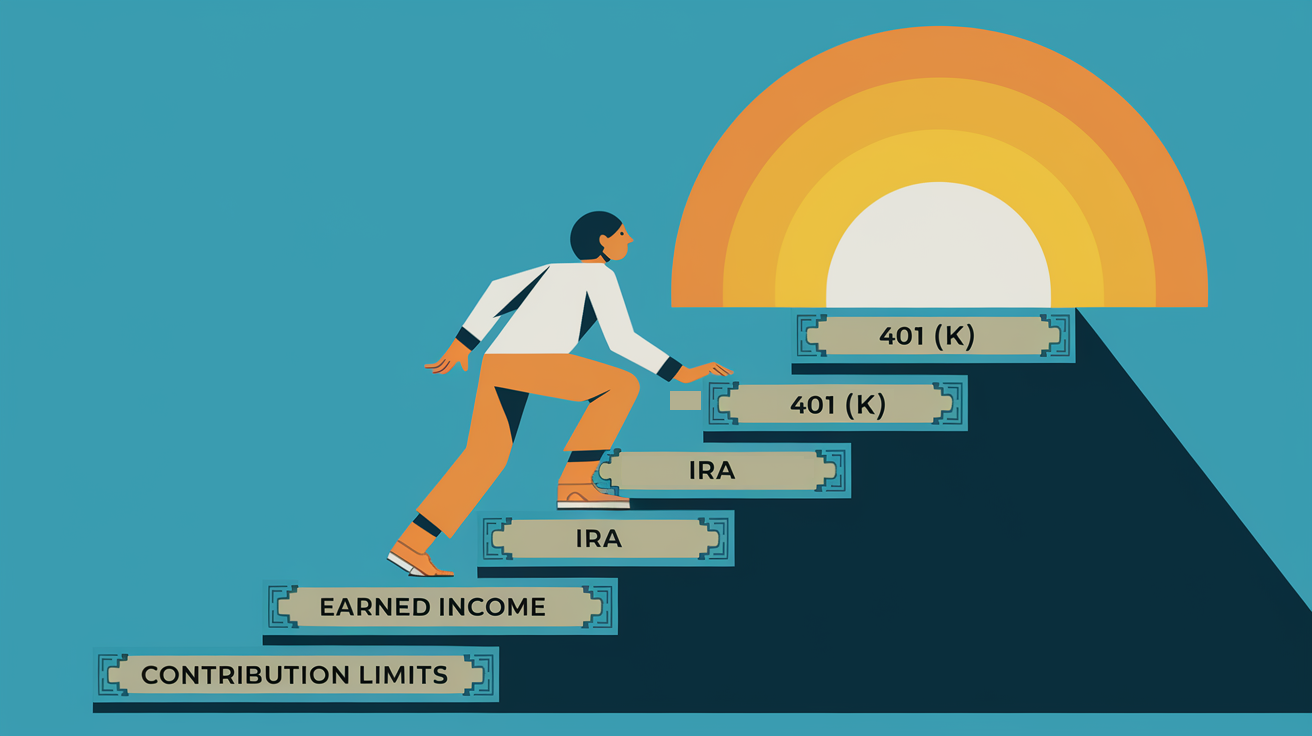

Client Background

Client Name: Mr. Brandon Evans

Situation: Mr. Brandon Evans had a vision of establishing a business in the United States. He had supply chain and other support services in place and had already assembled a team of staff. However, he lacked a clear plan for establishing the company in the U.S. and had a limited understanding of the legal requirements involved.

Client Name: Mr. Brandon Evans

Situation: Mr. Brandon Evans had a vision of establishing a business in the United States. He had supply chain and other support services in place and had already assembled a team of staff. However, he lacked a clear plan for establishing the company in the U.S. and had a limited understanding of the legal requirements involved.

Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the U.S.

Challenges Faced by the Client

Lack of Clear Business Plan: Mr. Evans had a business concept but lacked a comprehensive plan outlining the business's operations, location, ownership structure, and financial viability.

Unclear Business Entity: He needed guidance on selecting the appropriate business entity type (e.g., corporation, LLC) and understanding the implications of each choice.

Ownership and Investment: Mr. Evans needed to determine ownership distribution, investment amounts, and expected returns for potential investors.

Management Structure: For corporations, he had to choose officers and directors, while for LLCs, he needed to identify Managers or Members and establish their roles.

State of Incorporation: The selection of the state of incorporation and ensuring the chosen business name was available were important initial steps.

The Solution

Mr. Brandon Evans partnered with a team of experienced business consultants and legal experts who provided a step-by-step plan to streamline the business formation process. The following solutions were implemented:

Business Plan Development: A detailed business plan was created, outlining the business's activities, location, staffing, revenue model, and financial projections.

Entity Selection: After careful evaluation, Mr. Evans decided to form an LLC (Limited Liability Company) due to its flexibility and liability protection.

Ownership and Investment Planning: Ownership distribution and investment details were finalized, clarifying the expectations of investors.

Management Structure: As an LLC, Mr. Evans designated Managers and Members with defined roles and responsibilities.

State of Incorporation: Delaware was chosen as the state of incorporation due to its business-friendly environment and established legal framework.

Business Name and Indicator: A unique company name was selected, and it was ensured that the name was available for use. A suitable corporate indicator was also chosen.

Incorporation Filing: The necessary incorporation paperwork was filed with the state authorities, officially establishing the LLC.

Organizational Meeting and Operating Agreement: An organizational meeting was held to adopt the operating agreement, outlining how the business would be managed and governed.

Obtaining a Federal Tax Number (EIN): An Employer Identification Number (EIN) was obtained to facilitate tax reporting and compliance with federal and state regulations.

Bank Account Setup: A dedicated business bank account was opened to ensure the separation of personal and business finances.

Additional Financing: Mr. Evans secured additional financing to support the business's growth and operations.

Office Space Acquisition: A suitable office space was leased to serve as the company's operational headquarters.

Bookkeeping and Payroll System: An efficient bookkeeping and payroll system was established to maintain accurate financial records and ensure compliance.

Results

The implementation of these solutions yielded significant results for Mr. Brandon Evans's business:

The business was established smoothly, with a clear plan and structure in place..

Time and expenses were saved due to efficient planning and compliance, which was crucial for a foreign woman entrepreneur.

The business achieved profitability from the outset, thanks to a well-thought-out business plan and financial strategy.

Conclusion

This case study highlights the importance of seeking expert guidance and services when establishing a business, especially for individuals like Mr. Brandon Evans, who may lack a clear understanding of the legal and operational aspects involved. With the right assistance, entrepreneurs can streamline the business formation process, save time and expenses, and achieve profitability. Mr. Evans's successful business launch demonstrates the value of careful planning and professional guidance in the world of entrepreneurship.

With the right assistance, Mr. Brandon Evans can achieve success.

Empowered Business in the U.S.

Mr. Brandon Evans, initially lacking a clear business plan and

understanding of U.S. business laws, successfully established his LLC

in Delaware with the help of professional consultants. Through

meticulous planning, he achieved profitability in the first quarter and

maintained a stable profit in the following quarters.

#Business Formation

Empowered Business

in the U.S.

Introduction

In the highly competitive world of entrepreneurship, understanding the intricacies of business formation in a foreign country can be especially challenging. This case study examines how XOA TAX, a renowned financial and advisory services company, helped their foreign female client, Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the United States, despite her limited understanding of U.S. business regulations.

In the highly competitive world of entrepreneurship, understanding the intricacies of business formation in a foreign country can be especially challenging. This case study examines how XOA TAX, a renowned financial and advisory services company, helped their foreign female client, Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the United States, despite her limited understanding of U.S. business regulations.

Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the U.S.

Client Background

Ms. Joyce Ho, a motivated woman entrepreneur from Vietnam, had a vision for a thriving business in the United States. However, as a foreigner, she faced unique challenges and lacked a clear understanding of the legal requirements and procedures for establishing a business in a foreign country. Fearing potential legal pitfalls and cultural barriers, Ms. Joyce Ho sought professional assistance from XOA TAX.

Challenges Faced by the Foreign Female Client

Limited knowledge of U.S. business laws and regulations.

Uncertainty about roles and responsibilities of company officers and directors in a foreign context.

Confusion regarding the selection of U.S. shareholders, officers, and directors.

Limited understanding of U.S. capitalization and entity types (LLC or S-corp).

Concerns about multi-state registration and compliance in a foreign country.

Anxiety about obtaining a U.S. federal Employer Identification Number (EIN) as a foreigner.

Unclear process for opening a U.S. business bank account as a foreigner.

Overall, a lack of clear strategies and knowledge to initiate and manage a profitable business in the U.S.

Solution

XOA TAX's team of experienced business consultants and legal experts devised a comprehensive plan to assist Ms. Joyce Ho, a foreign woman entrepreneur,

in achieving her entrepreneurial goals in the United States. The following steps were taken:

Roles and Responsibilities Determination: XOA TAX worked closely with Ms. Joyce Ho to outline the roles and responsibilities of the company's officers and directors in the U.S., considering the unique aspects of operating a foreign-owned business.

Shareholders, Officers, and Directors Selection: Through thorough discussions, XOA TAX helped Ms. Joyce Ho identify suitable individuals for these key positions in compliance with U.S. regulations.

Capitalization Planning: XOA TAX assisted in determining the appropriate capitalization structure for the U.S. business, ensuring compliance with U.S. financial requirements.

Entity Type Recommendations: After evaluating the specific needs and goals of Ms. Joyce Ho's U.S. business, XOA TAX recommended the establishment of an LLC (Limited Liability Company) due to its flexibility and limited liability protection, while considering the foreign ownership.

Multi-State Registration: To expand the business reach in the U.S., XOA TAX facilitated the registration of the company in multiple states, ensuring compliance with U.S. state regulations.

EIN Acquisition: XOA TAX successfully obtained a U.S. federal Employer Identification Number (EIN) for the company, navigating the unique requirements for foreign entrepreneurs.

U.S. Bank Account Setup: XOA TAX advised Ms. Joyce Ho to open a dedicated U.S. business bank account as a foreigner, ensuring compliance with U.S. financial regulations.

Business Launch and Strategies: XOA TAX provided comprehensive business strategies tailored to Ms. Joyce Ho's industry and target market in the U.S., accounting for cultural nuances and market dynamics.

Bookkeeping and Payroll System: XOA TAX helped establish an efficient U.S. bookkeeping and payroll system, ensuring accurate financial records and compliance with U.S. tax regulations.

Results

The implementation of the above solutions yielded remarkable results for Ms. Joyce Ho's foreign-owned business in the United States:

The business was established smoothly, with a clear structure and well-defined roles and responsibilities adapted for foreign ownership.

Time and expenses were saved due to efficient planning and compliance, which was crucial for a foreign woman entrepreneur.

The business became profitable from the outset, achieving a net income increase of 275% in the second quarter, which stabilized in the third quarter.

Conclusion

This case study underscores the significance of seeking expert guidance and services from companies like XOA TAX when foreign women entrepreneurs aim to establish businesses in a foreign country, such as the United States. With the right assistance, foreign women entrepreneurs like Ms. Joyce Ho can successfully navigate the complexities of U.S. business formation, ensuring profitability and compliance from the start. XOA TAX's expertise in legal matters, strategic planning, and financial management played a pivotal role in achieving these outstanding results for a foreign woman entrepreneur venturing into the U.S. market.

Plan to Success

Mr. Brandon Evans, initially lacking a clear business plan and understanding of U.S. business laws, successfully established his LLC in Delaware with the help of professional consultants. Through meticulous planning, he achieved profitability in the first quarter and maintained a stable profit in the following quarters.

our #Success Stories

Explore real-life case studies, showcasing personal and business successes

that inspire and inform

#Tax #Accounting

E-commerce Startup

In 2019, Mr. Jackson, an experienced businessman who owns a range of various companies, started an exciting new online store. He didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

#Tax #Accounting

Stuck in a special situation

Dustin and Rosie were faced with a tax bill ofchain over 2 million USD when they invested in the stock market. Knowing the gravity of their situation, they reached out to us for help. With years of experience in solving tax issues, our tax attorney sent the IRS papers that explained the couple's financial hardships. After a thorough review, the IRS agreed with them and cut their tax bill by more than half, which saved them over $1 million USD.

#Tax #Accounting

Empowered Business in the U.S.

Joyce Ho, a determined entrepreneur from Vietnam, sought assistance from XOA TAX to navigate the complexities of establishing a business in the U.S. XOA TAX provided comprehensive help so that Joyce Ho's foreign-owned business not only launched successfully but also achieved profitability early on.

#Tax #Accounting

Plan to Success

Mr. Brandon Evans, initially lacking a clear business plan and understanding of U.S. business laws, successfully established his LLC in Delaware with the help of professional consultants. Through meticulous planning, he achieved profitability in the first quarter and maintained a stable profit in the following quarters.

We’ve Got A Plan That’s Perfect For Your Business

From basic tax to complex accounting, we got you covered!

Basic plan

Quarterly Bookkeeping and Bank Reconciliation (Max 50 transactions/month)

For annual revenue of $1 million and up, contact us for custom pricing.

FEATURES

- QBO Simple Start Subscription

- Transaction Processing

- Fixed Assets Register

- Trial Balance Preparation

- Data Security and Backups

- General Ledger Maintenance

- Month-End Close

- Business Tax Preparation

- Month-End Close

-

Individual Tax Preparation

- Email Support Only

Pro plan

- Popular

Quarterly Bookkeeping and Bank Reconciliation (Max 150 transactions/month)

For annual revenue of $1 million and up, contact us for custom pricing.

FEATURES

Everything in Basic plan and More

- QBO Subscription

- Sales Tax Reconcilations

- Payroll Reconcilations

- Loan Amortization

- Business Tax Preparation

- Unlimited Phone & Email Support

Elite plan

Monthly Bookkeeping and Bank Reconciliation (Max 300 transactions/month)

For annual revenue of $1 million and up, contact us for custom pricing.

FEATURES

Everything in Basic plan and Pro plan

- Audit Support

- Accounts Receivable Management

- Accounts Payable Management

- Inventory Tracking

- Perform COGS and Refund COST

- Merchant Reconciliation

- Free Tax Planning with CPAs

- Estimated Tax Payment Preparation

- Annual Corporation Renewal (State fees apply)

Customized Tax and

Accounting Solution

Every business needs a reliable partner. From accounting to helpful business insights, we are here for you.

Check Our Clients Feedback!

Excellent

and

Excellent

Chinh N. Elite 23

Anaheim, CA

- 120

- 394

- 52

Aug 2, 2021

Been looking for a tax preparer CPA office that provides top-notch services and I finally found it here.

Been looking for a tax preparer CPA office that provides top-notch services and I finally found it here. I worked with Uyen and she is very prompt answering my questions and concerns. I was able to submit and have everything completed in the comfort of my home. And even after I submitted my taxes and had issues, they were still diligent in helping me address it.Definitely a return customer and would recommend this to anyone needing their taxes prepared.

Nhi H.

Garden Grove, CA

- 44

- 24

- 12

Apr 9, 2021

Found XOA TAX on Google and they’ve been a life-saver with dealing with my stressful IRS issue that came up

Found XOA TAX on Google and they’ve been a life-saver with dealing with my stressful IRS issue that came up I met with attorney Thinh, whom I was very impressed with Thinh took the time to listen and understand the complexity of my tax situation. I never felt pressured or that he was hard selling. I felt reassured and confident He gave me several options on how to deal with the IRS and the California franchise tax, and we came up with a genius plan together. In the end he surpassed all my expectation. Hoang also provided helpful suggestions for planning my tax payments next year. I also refer a friend who had a similar tax law issue, he seems to also be thrilled with his services. I’m so glad that I found a firm like this one to take care of my tax needs. They’re the best in town! Thank you and see you next year!!!

Eric N.

Anaheim, CA

- 109

- 9

- 1

Dec 28, 2021

I was impressed with the straightforward tax preparation service I received

I was impressed with the straightforward tax preparation service I received. Although my taxes are typically simple this year’s situation was more complex than I could handle alone. I contacted Hoang and he responded very promptly. The cost was a bit higher than expected but ultimately worthwhile for the expertise and efficiency provided I submitted all of my documentation and my taxes were completed just two weeks later. I knew I would owe taxes this year and was dreading the process so I’m grateful it was handled smoothly and quickly. Hoang also provided helpful suggestions for planning my tax payments next year. I don’t live live in CA anymore but I will likely return to Hoang next tax season because I feel like I can trust him & his team.

Ut Q.

El Monte, CA

- 44

- 24

- 12

Jan 10, 2022

Running a business can be rewarding, but at times challenging. Doing your own taxes as business owner is stressful and time consuming.Atleast that is for me.

Running a business can be rewarding, but at times challenging. Doing your own taxes as business owner is stressful and time consuming.Atleast that is for me. I contacted Thinh over a year ago to discuss our taxes and he responded quickly. We met for a consultation, I explained the mess with our taxes and we discussed strategies on how to better understand my legal obligations as well as his in terms of investing offshore matters. He was helpful getting my tax situation in order and made the conversation about sensitive topics easy.The attorney gave me good advice about dos and don’t in business as well as a few referrals for matters that he doesn’t deal with. He didn’t make me feel annoyed by the legal jargon and instead explained how they work.Their pricing is fair. You’re paying for someone who has the expertise and time to help with things that you don’t want to deal with. I’ll be working with them again without a doubt.

and

Nhi Huynh

Local Guide • 87 reviews • 428 photos

2 years ago

Positive: Professionalism, Quality.

Found XOA TAX on Google and they’ve been a life-saver with dealing with my stressful IRS issue that came up.

Found XOA TAX on Google and they’ve been a life-saver with dealing with my stressful IRS issue that came up. I met with attorney Thinh, whom I was very impressed with. Thinh took the time to listen and understand the complexity of my tax situation. I never felt pressured or that he was hard selling. I felt reassured and confident that my case would be handled well. He gave me several options on how to deal with the IRS and the California franchise tax, and we came up with a genius plan together. In the end he surpassed all my expectation. I also refer a friend who had a similar tax law issue, he seems to also be thrilled with his services. I’m so glad that I found a firm like this one to take care of my tax needs. They’re the best in town! Thank you and see you next year

Or Oakil

Local Guide • 87 reviews • 428 photos

2 years ago

Positive: Professionalism, Quality.

I have bee using their services for a couple years and I am satisfied.

Joann M. Britton

Local Guide • 87 reviews • 428 photos

2 years ago

Positive: Professionalism, Quality.

They performed a fantastic job submitting our little business’s taxes.

They performed a fantastic job submitting our little business’s taxes. Very helpful employees that made the procedure quick and easy! Highly advised for everyone looking for tax assistance! Once again, thanks.

Martha C. Parker

Local Guide • 6 reviews • 31 photos

2 years ago

Positive: Professionalism, Quality.

I just had my taxes done by Hoang and his team. It was very well organized, fast and decent price.

I just had my taxes done by Hoang and his team. It was very well organized, fast and decent price. They are very knowledgeable, friendly and avail to answer any questions. I would highly recommend XOA TAX. Thank you!

Saef Saef

Local Guide • 87 reviews • 428 photos

2 years ago

Positive: Professionalism, Quality.

I had a very complex tax year and my usual accountant was not available

I had a very complex tax year and my usual accountant was not available to help. Which lead me to XOA TAX, they were prepared to tackle my 2020 taxes! My experience with XOA TAX was a pleasant one. They always responded quickly to my questions, were professional and friendly- traits that made it easy for me to trust them. I highly recommend them and will return next year!

Alexis Jenkins

Local Guide • 6 reviews • 31 photos

2 years ago

Positive: Professionalism, Quality.

As a software engineer, I was suggested to Hoang by a friend. Uyen not only did an

As a software engineer, I was suggested to Hoang by a friend. Uyen not only did an

excellent job on my taxes, but she also maintained her word and returned my call

within 24 hours of getting all the paperwork (taxes). She not only called me back

when she said she would, but she also chatted to me as if I were a friend. Her

knowledge and passion for what she does wowed me. I couldn’t think of anything

I couldn’t think of anything I could have done differently because everything went so smoothly. The very best.

Their services were completed in less than 10 days, compared to other internet advisors or tax prepares!

Business & Tax Tips

Learn about taxes, bookkeeping tips, and how to grow your small business.

Customized for Your Business Needs

Skip weekends in paperworks. #Thrive with our CPAs.

CONTACT XOA TAX NOW

Accurate & Fast Accounting

Services with Experts

# Tax #Accounting

E-commerce

Startup

The Situation

In 2019, Mr. Jackson, an experienced businessman who owns a range of various companies, started an exciting new online store. Even though he had a lot of experience, he depended on a personal accountant to help him with the complicated finances of his new business.

Even though the accountant was skilled, they didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

In 2019, Mr. Jackson, an experienced businessman who owns a range of various companies, started an exciting new online store. Even though he had a lot of experience, he depended on a personal accountant to help him with the complicated finances of his new business.

Even though the accountant was skilled, they didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

The solution

To deal with these issues, Mr. Jackson reached out to our professional services. We decided to gather all the necessary documents and paperwork ever since to correct the tax records and assessments. This effort was essential to avoid potential pitfalls associated with incorrect tax filings.

The result

“He was able to avoid being audited, and

make his first online store thrive!”

If we hadn't fixed these tax problems, the business would have run into some serious trouble down the road. Making mistakes in tax filings could have triggered an audit in the future, leading to substantial financial burdens and the risk of harming the company's good name.

By dealing with these financial issues, we essentially removed a major obstacle, enabling the business to keep growing without worrying about audits and financial penalties on the horizon.

# Tax #Accounting

Stuck In A

Special Situation

The Situation

Dustin and Rosie, a middle-aged couple, chose to do something brave. They sold their family home and all their assets to invest in the stock market. As their gamble paid off, they made a substantial profit. However, with great profits came a significant tax liability. Unprepared for this, they were faced with a tax bill of over 2 million USD.

Dustin and Rosie, a middle-aged couple, chose to do something brave. They sold their family home and all their assets to invest in the stock market. As their gamble paid off, they made a substantial profit. However, with great profits came a significant tax liability. Unprepared for this, they were faced with a tax bill of over 2 million USD.

The solution

Recognizing the seriousness of their situation, Dustin and Rosie sought our assistance. We connected them with a board-certified tax attorney who had a wealth of experience in handling tax-related challenges.

The tax attorney prepared and sent a detailed report to the IRS, explaining the couple's financial difficulties. The argument made was that, despite their profit, they couldn't reasonably afford such a high tax bill because they had already invested all their life savings and assets in the stock market.

The result

“He was able to avoid being audited, and

make his first online store thrive!”

After a thorough review, the IRS understood their situation and decided to reduce their tax bill by more than half. This substantial reduction saved Dustin and Rosie over $1 million USD. With this financial relief, they could eventually handle their life without the overwhelming burden of excessive debt.Even though the accountant was skilled, they didn't know much about how to tax online purchases. Because of this, there were some mistakes in the company's financial records. The tax forms did not list the distribution funds and withdrawals of capital. There were a lot of blank spots in the books where income and expenses should have been written, and deals were not properly recorded.

The solution

To deal with these issues, Mr. Jackson reached out to our professional services. We decided to gather all the necessary documents and paperwork ever since to correct the tax records and assessments. This effort was essential to avoid potential pitfalls associated with incorrect tax filings.

The result

“He was able to avoid being audited, and

make his first online store thrive!”

If we hadn't fixed these tax problems, the business would have run into some serious trouble down the road. Making mistakes in tax filings could have triggered an audit in the future, leading to substantial financial burdens and the risk of harming the company's good name.

By dealing with these financial issues, we essentially removed a major obstacle, enabling the business to keep growing without worrying about audits and financial penalties on the horizon.

#Business Formation

Empowered Business

in the U.S.

Introduction

In the highly competitive world of entrepreneurship, understanding the intricacies of business formation in a foreign country can be especially challenging. This case study examines how XOA TAX, a renowned financial and advisory services company, helped their foreign female client, Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the United States, despite her limited understanding of U.S. business regulations.

In the highly competitive world of entrepreneurship, understanding the intricacies of business formation in a foreign country can be especially challenging. This case study examines how XOA TAX, a renowned financial and advisory services company, helped their foreign female client, Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the United States, despite her limited understanding of U.S. business regulations.

Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the U.S.

Client Background

Ms. Joyce Ho, a motivated woman entrepreneur from Vietnam, had a vision for a thriving business in the United States. However, as a foreigner, she faced unique challenges and lacked a clear understanding of the legal requirements and procedures for establishing a business in a foreign country. Fearing potential legal pitfalls and cultural barriers, Ms. Joyce Ho sought professional assistance from XOA TAX.

Challenges Faced by the Foreign Female Client

Limited knowledge of U.S. business laws and regulations.

Uncertainty about roles and responsibilities of company officers and directors in a foreign context.

Confusion regarding the selection of U.S. shareholders, officers, and directors.

Limited understanding of U.S. capitalization and entity types (LLC or S-corp).

Concerns about multi-state registration and compliance in a foreign country.

Anxiety about obtaining a U.S. federal Employer Identification Number (EIN) as a foreigner.

Unclear process for opening a U.S. business bank account as a foreigner.

Overall, a lack of clear strategies and knowledge to initiate and manage a profitable business in the U.S.

Solution

XOA TAX's team of experienced business consultants and legal experts devised a comprehensive plan to assist Ms. Joyce Ho, a foreign woman entrepreneur,

in achieving her entrepreneurial goals in the United States. The following steps were taken:

Roles and Responsibilities Determination: XOA TAX worked closely with Ms. Joyce Ho to outline the roles and responsibilities of the company's officers and directors in the U.S., considering the unique aspects of operating a foreign-owned business.

Shareholders, Officers, and Directors Selection: Through thorough discussions, XOA TAX helped Ms. Joyce Ho identify suitable individuals for these key positions in compliance with U.S. regulations.

Capitalization Planning: XOA TAX assisted in determining the appropriate capitalization structure for the U.S. business, ensuring compliance with U.S. financial requirements.

Entity Type Recommendations: After evaluating the specific needs and goals of Ms. Joyce Ho's U.S. business, XOA TAX recommended the establishment of an LLC (Limited Liability Company) due to its flexibility and limited liability protection, while considering the foreign ownership.

Multi-State Registration: To expand the business reach in the U.S., XOA TAX facilitated the registration of the company in multiple states, ensuring compliance with U.S. state regulations.

EIN Acquisition: XOA TAX successfully obtained a U.S. federal Employer Identification Number (EIN) for the company, navigating the unique requirements for foreign entrepreneurs.

U.S. Bank Account Setup: XOA TAX advised Ms. Joyce Ho to open a dedicated U.S. business bank account as a foreigner, ensuring compliance with U.S. financial regulations.

Business Launch and Strategies: XOA TAX provided comprehensive business strategies tailored to Ms. Joyce Ho's industry and target market in the U.S., accounting for cultural nuances and market dynamics.

Bookkeeping and Payroll System: XOA TAX helped establish an efficient U.S. bookkeeping and payroll system, ensuring accurate financial records and compliance with U.S. tax regulations.

Results

The implementation of the above solutions yielded remarkable results for Ms. Joyce Ho's foreign-owned business in the United States:

The business was established smoothly, with a clear structure and well-defined roles and responsibilities adapted for foreign ownership.

Time and expenses were saved due to efficient planning and compliance, which was crucial for a foreign woman entrepreneur.

The business became profitable from the outset, achieving a net income increase of 275% in the second quarter, which stabilized in the third quarter.

Conclusion

This case study underscores the significance of seeking expert guidance and services from companies like XOA TAX when foreign women entrepreneurs aim to establish businesses in a foreign country, such as the United States. With the right assistance, foreign women entrepreneurs like Ms. Joyce Ho can successfully navigate the complexities of U.S. business formation, ensuring profitability and compliance from the start. XOA TAX's expertise in legal matters, strategic planning, and financial management played a pivotal role in achieving these outstanding results for a foreign woman entrepreneur venturing into the U.S. market.

#Business Formation

Plan to Success

Client Background

Client Name: Mr. Brandon Evans

Situation: Mr. Brandon Evans had a vision of establishing a business in the United States. He had supply chain and other support services in place and had already assembled a team of staff. However, he lacked a clear plan for establishing the company in the U.S. and had a limited understanding of the legal requirements involved.

Client Name: Mr. Brandon Evans

Situation: Mr. Brandon Evans had a vision of establishing a business in the United States. He had supply chain and other support services in place and had already assembled a team of staff. However, he lacked a clear plan for establishing the company in the U.S. and had a limited understanding of the legal requirements involved.

Ms. Joyce Ho from Vietnam, achieve a smooth and profitable business launch in the U.S.

Challenges Faced by the Client

Lack of Clear Business Plan: Mr. Evans had a business concept but lacked a comprehensive plan outlining the business's operations, location, ownership structure, and financial viability.

Unclear Business Entity: He needed guidance on selecting the appropriate business entity type (e.g., corporation, LLC) and understanding the implications of each choice.

Ownership and Investment: Mr. Evans needed to determine ownership distribution, investment amounts, and expected returns for potential investors.

Management Structure: For corporations, he had to choose officers and directors, while for LLCs, he needed to identify Managers or Members and establish their roles.

State of Incorporation: The selection of the state of incorporation and ensuring the chosen business name was available were important initial steps.

The Solution

Mr. Brandon Evans partnered with a team of experienced business consultants and legal experts who provided a step-by-step plan to streamline the business formation process. The following solutions were implemented:

Business Plan Development: A detailed business plan was created, outlining the business's activities, location, staffing, revenue model, and financial projections.

Entity Selection: After careful evaluation, Mr. Evans decided to form an LLC (Limited Liability Company) due to its flexibility and liability protection.

Ownership and Investment Planning: Ownership distribution and investment details were finalized, clarifying the expectations of investors.

Management Structure: As an LLC, Mr. Evans designated Managers and Members with defined roles and responsibilities.

State of Incorporation: Delaware was chosen as the state of incorporation due to its business-friendly environment and established legal framework.

Business Name and Indicator: A unique company name was selected, and it was ensured that the name was available for use. A suitable corporate indicator was also chosen.

Incorporation Filing: The necessary incorporation paperwork was filed with the state authorities, officially establishing the LLC.

Organizational Meeting and Operating Agreement: An organizational meeting was held to adopt the operating agreement, outlining how the business would be managed and governed.

Obtaining a Federal Tax Number (EIN): An Employer Identification Number (EIN) was obtained to facilitate tax reporting and compliance with federal and state regulations.

Bank Account Setup: A dedicated business bank account was opened to ensure the separation of personal and business finances.

Additional Financing: Mr. Evans secured additional financing to support the business's growth and operations.

Office Space Acquisition: A suitable office space was leased to serve as the company's operational headquarters.

Bookkeeping and Payroll System: An efficient bookkeeping and payroll system was established to maintain accurate financial records and ensure compliance.

Results

The implementation of these solutions yielded significant results for Mr. Brandon Evans's business:

The business was established smoothly, with a clear plan and structure in place..

Time and expenses were saved due to efficient planning and compliance, which was crucial for a foreign woman entrepreneur.

The business achieved profitability from the outset, thanks to a well-thought-out business plan and financial strategy.

Conclusion

This case study highlights the importance of seeking expert guidance and services when establishing a business, especially for individuals like Mr. Brandon Evans, who may lack a clear understanding of the legal and operational aspects involved. With the right assistance, entrepreneurs can streamline the business formation process, save time and expenses, and achieve profitability. Mr. Evans's successful business launch demonstrates the value of careful planning and professional guidance in the world of entrepreneurship.

With the right assistance, Mr. Brandon Evans can achieve success.